While the CNBC pundits try to figure out when NVDA 0.00%↑ will reach the $1,000 per share level and when Bitcoin will hit $100,000, I find it more productive to think more second level about the AI and crypto booms bubbles using the old Gold Rush “Picks & Shovels” strategy.

First of all, I think there is a good chance that AI will continue to grow and become a bigger part of everyday life. But, I also believe there is a lot of uncertainty about whether the current market leaders can continue to maintain their lead in the AI sector. Stocks like NVDA 0.00%↑ and SMCI 0.00%↑ seem to be overhyped and overvalued. Using history as a guide, I am skeptical that these high fliers will still be flying high in 5 years time. Going back to previous technology breakthroughs shows that most of the early leaders get lost in the pack as the technology develops and is adopted.

Crypto mining and AI use tremendous amounts of energy. I am fascinated by the fact that a single Nvidia H100 chip uses as much energy as a typical American household.

With crypto, the upcoming Bitcoin halving is significantly increasing the amount of energy used in Bitcoin mining.

Additional AI adoption and crypto mining will just add to energy demand caused by the already existing trend of the developing world catching up to 1st world living standards. More energy demand means that ramping up power generation will be a pressing need.

If you think renewables are the way of the future (I have my doubts), then investing in raw materials like lithium, copper and silver needed for batteries, solar panels and wind turbines makes sense.

If you believe that renewables are not going to be able to meet a significant portion of future energy demands, then investing in areas that should benefit from increased nuclear, oil, natural gas and coal power generation is the way to go. This is the path that I’m taking with major portions of my portfolio invested in uranium, and energy companies.

With increased electrical demand, the grid will also need to be expanded. Investing in commodities such as copper and tin could be profitable.

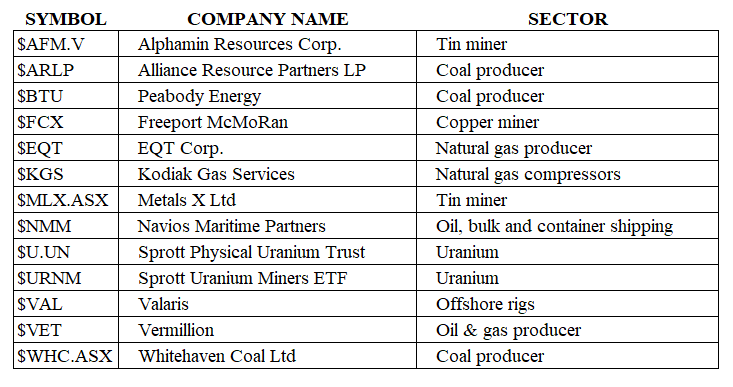

Personally, I am looking to profit from this trend by investing in these specific stocks either through owning shares and/or call options:

Similar thoughts. I own FCX, CVE, PDER and the ETF COPX. PDER is a tiny land manager that has been around since 1840. Focus is on hardwoods, coal, oil & gas and some solar farms. They pay $1.80 a quarter and usually pay a special in Dec. Trades by appointment so takes time to build a position. B/R